Paytm Has Turned Contribution Margin Positive — A Good Sign For Profitability

India’s leading digital payments and financial services platform Paytm on July 15, 2021, filed the first official papers for its much-awaited IPO. The company is heading for a market debut with an aim to raise $2.2 billion, which is touted to be India’s largest IPO.

The company’s DRHP reveals its financial aspect, which shows how the company is growing. Paytm has acknowledged its losses and the potential of profitability in its prospectus. However, the numbers say a different story. Paytm has a robust revenue of ₹3186 crores, much higher than its competitors, and has also been cutting down its losses massively.

In FY21, the company cut its losses by 42% on a year-on-year basis, which is a continuation of a trend that had set in since FY19.

In FY19, Paytm reported losses of Rs4230 crore, in FY20, the company brought it down to Rs2942 crore, and in FY21, brought it down even further to Rs1701 crore.

Also Read: Shree Cements to Gift India’s Olympic Winners Free Cement to Build their Dream Homes

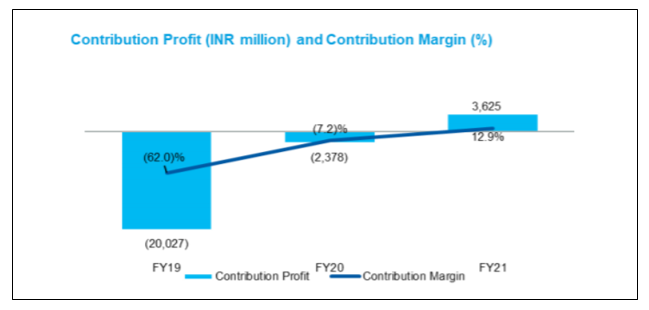

This progress was also seen in the DRHP, in which the company revealed that it has turned contribution margin positive. “Our contribution profit improved from a loss of Rs 19,980 million in FY 2019 to a profit of Rs3,625 million in FY 2021. Our contribution margin increased from a loss of 61.8% in FY 2019 to a profit of 12.9% in FY 2021,” the company said in its DRHP.

Paytm has been able to achieve these numbers by cutting down on its marketing and promotional spends massively. In FY19, Paytm recorded losses of Rs 34,083 million, in FY20, the company reduced it to Rs 13,971 million and in FY21 saw a massive reduction to Rs5,325 million.

These numbers reflect that the company’s growth is not dependent on cashback-driven incentives, as the company’s revenue from payments and financial services increased in FY 2021 as compared to FY 2020.