Selling Frenzy in Indian Equity Markets After US Down Turn

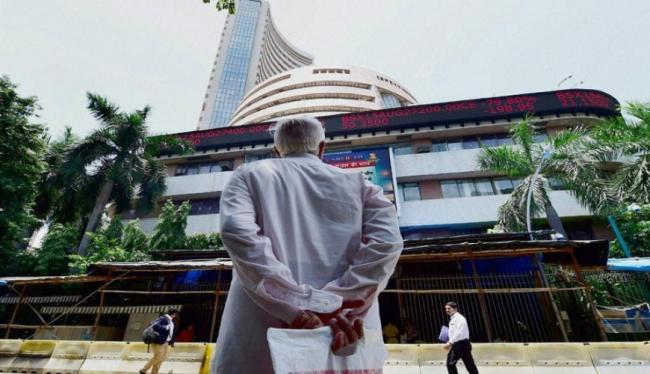

Mumbai: A massive downturn in the US and East Asian stock markets unleashed a selling frenzy in the Indian equity markets during the trade session on Tuesday.

The two main indices of the Indian equity market -- S&P BSE Sensex and NSE Nifty50 -- plunged by around 3.30 per cent each, with the Sensex plunging by over 1,000 points. Market observers pointed-out that factors like the budgetary proposal to tax long-term gains on shares and concerns over the central government's fiscal prudence measures amplified the global downturn.

Also read:

Banks Will Decide Interest Rates: Finance Minister

Global Cues Pull Indian Equity Market Deep Into Red

Record Plunge Hits Dow Jones Stock Index

All the major Asian stock markets -- Nikkei, Hang Seng, Shaghai, Taipei, Seoul and Singapore -- edged-lower following an overnight downward correction in Dow Jones by over 1,100 points. Just after the pre-open session, the barometer 30-scrip Sensitive Index of the BSE traded more than 1,000 points or 2.90 per cent lower from Monday's close. Similarly, the wider Nifty50 of the National Stock Exchange receded deep into the red. It plunged by over 300 points or 3.00 per cent. Around 12.00 p.m., the Sensex traded lower by 1,023.77 points or 2.95 per cent to 33,733.39 points from its previous close of 34,757.16 points.

The NSE Nifty50 traded lower by 311.35 points or 2.92 per cent at 10,355.20 points. "The unprecedented downfall in Dow yesterday (Monday) and combination of other negative factors like the high fiscal deficit projected and proposal on LTCG and fear of the stand that the RBI (Reserve Bank of India) will take during Wednesday's review has led to this melt-down or selling panic," Deepak Jasani, Head, Retail Research, HDFC Securities said.

IANS