Equity Markets Pare Early Gains on Profit Booking, Re Slips 9 Paise

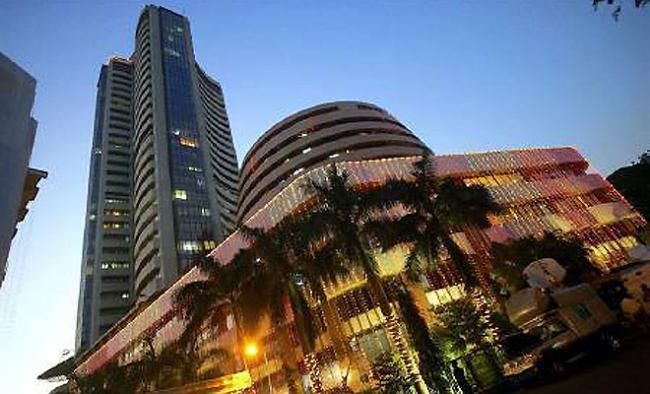

Mumbai: Indian equity markets on Wednesday succumbed to profit booking to close the session on a flat note. The key indices were moving up on value buying until 1pm, but profit booking coupled with heavy selling pressure in FMCG and banking stocks eroded early gains.

The wider Nifty inched up by 1.25 points or 0.01 per cent, to 8,777.15 points. In contrast, the barometer 30-scrip Sensex closed at 28,507.42 points, down 15.78 points or 0.06 per cent from the previous close at 28,523.20 points.

Opened at 28,554.38 points, Sensex touched a high of 28,689.36 points and a low of 28,462.33 points during the intra-day trade. However, the BSE market breadth was tilted in favour of the bulls with 1,405 advances and 1,277 declines.

On Tuesday, the benchmark indices had ended in the red due to caution ahead of major global financial events and profit-booking. The barometer index had slipped by 111.30 points or 0.39 per cent, while the NSE Nifty edged down 32.50 points, or 0.37 per cent.

Rupee Slips 9 Paise vs USD

Coming to Inter-bank foreign exchange (forex) market, rupee dropped from early gains and down by nine paise to 67.10 against the US dollar. Rupee turned weaker on sustained bouts of dollar demand from importers and banks despite higher domestic equities.

The rupee opened a tad higher at 67 as against Tuesday’s closing of 67.01 per dollar at the forex market.

It gained further to 66.98 on bouts of dollar selling from banks before quoting at 67.10. The domestic unit hovered in a range of 67.1450 to 66.98 in the morning deals. Meanwhile, the dollar index was up 0.29 per cent at 96.29 against a basket of six currencies.

Overseas, the US dollar trading in narrow range against the basket currencies in early Asian trade, penned in by uncertainty about the outcome of Bank of Japan (BoJ) and Federal Reserve policy meetings later in the session.

Source: IANS/ PTI